- The Reserve Bank of India (RBI) on Wednesday decided to withdraw all currency notes issued prior to 2005, including Rs 500 and Rs 1,000 denominations, after March 31 in a move apparently aimed at curbing black money and fake currencies.

- "After March 31, 2014, it (RBI) will completely withdraw from circulation all bank notes issued prior to 2005. From April 1, 2014, the public will be required to approach banks for exchanging these notes," the RBI said in a statement.

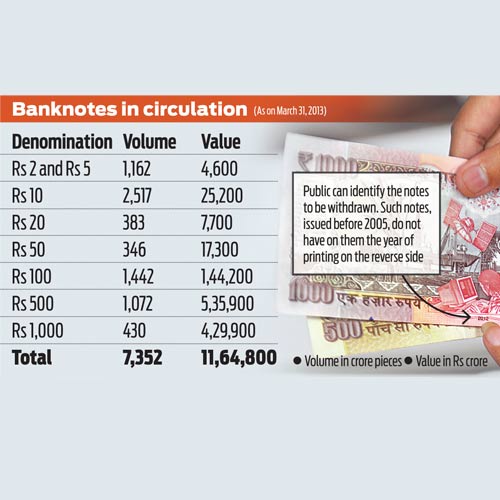

- The public can easily distinguish the currency notes issued before 2005 as they do not have the year of printing on reverse side. The year of printing in a small font is visible at the middle of the bottom row in notes issued after 2005.

- Asking people not to panic and cooperate in the withdrawal process, the RBI said old notes will continue to be legal and can be exchanged in any bank after April 1.

- "From April 1, 2014, the public will be required to approach banks for exchanging these notes. Banks will provide exchange facility for these notes until further communication," the RBI said.

- From July 1, 2014, persons seeking exchange of more than 10 pieces of Rs 500 and Rs 1,000 notes will have to furnish proof of identity and residence to the bank.

- Although the RBI did not give any reason for withdrawal of pre-2005 currency notes, the move is expected to unearth black money held in cash.

- As the new currency notes have added security features, they would help in curbing the menace of fake currency.

- At present, currency notes in denominations of Rs 5, Rs 10, Rs 20, Rs 50, Rs 100, Rs 500 and Rs 1,000 are issued.

The falloutBlack money: The impact is as good as demonetisation as currencies printed before 2005 will no longer be in circulation. The RBI has given an opportunity to exchange notes through banks only. This means hoarders of cash will automatically come under the lens if they approach banks.

They are likely to employ benami names or front companies to get notes exchanged for new ones at a premium of 10-15 per cent.

Corruption: Bank employees could resort to devious ways to make a quick buck or bail out

customers. Eventually the government and RBI win by giving a body blow to counterfeit notes and hoarders of cash.

customers. Eventually the government and RBI win by giving a body blow to counterfeit notes and hoarders of cash.

Gold & real estate: Unlikely to have an impact as the move is to tackle fake currency. The move discourages cash transactions if currency does not have the year of printing mentioned on the reverse of the note.

All you need to know

What might be RBI’s thinking in phasing out pre-2005 currency notes by March 31?The RBI has not specified the reasons, but the general perception is that it is keen to rationalise all banknotes in circulation. One theory is that the RBI is aiming to unearth black money held in cash and curb fake or counterfeit currency notes.

How exactly will the new banknotes help?The post-2005 notes have added security features like machine-readable security thread that fluoresces in yellow on both sides under ultraviolet light; improved intaglio printing; see-through register which ensures half the numeral of each denomination is printed on the obverse (front) and half on the reverse; water-mark and electrotype watermark that can be viewed better when the banknote is held against light; optically variable ink which makes the colour of the numeral appear green when the banknote is held flat but blue when the banknote is held at an angle; dual-coloured optical fibres, seen under ultra-violet lamp; and, of course, year of printing. These features help banks across the world to stay ahead of counterfeiters.

Are notes of only certain denominations being withdrawn?No. The RBI has advised that after March 31, 2014, it will completely withdraw from circulation all banknotes issued prior to 2005. At present, currency notes in denominations of Rs5, Rs10, Rs20, Rs50, Rs100, Rs500 and Rs1,000 are issued.

What is the procedure to exchange old notes?From April 1, people will have to approach banks to exchange pre-2005 notes.

Is this move a cause for worry or panic?The RBI has appealed to the public not to panic. People are requested to actively cooperate in the currency note withdrawal process.

What will happen if pre-2005 notes are not exchanged for new ones at banks after March 31? Will the pre-2005 currency notes cease to be legal tender? The RBI has clarified that the notes issued before 2005 will continue to be legal tender. This would mean that banks are required to exchange the notes for their customers as well as for non-customers. From July 1, 2014, however, to exchange more than 10 pieces of Rs500 and Rs1,000 notes, non-customers will have to furnish proof of identity and residence to the bank branch in which she/he wants to exchange the notes. Banks will provide exchange facility for these notes until further communication from the RBI.

Will banks be able to replace all old notes with new ones?There is not much clarity. Details are awaited.

Will the RBI move lead to excessive workload on banks?This appears likely. Long queues of people seeking to exchange notes are conceivable.

Will people with loads of old currency notes (euphemism for black money) try to divert them to commodities like gold?Well, some might. The jury is still out on whether this is a prudent move though.

If gold-sellers accept such old notes, what can they do? All such notes will eventually have to find their way to banks, a prospect that not all gold-sellers might relish.

What might be the number & worth of all pre-2005 notes? As per RBI data, as of December 2005, there were 3,785 crore pieces of banknotes in circulation, worth about Rs4 lakh crore.

No comments:

Post a Comment